12/18/2021

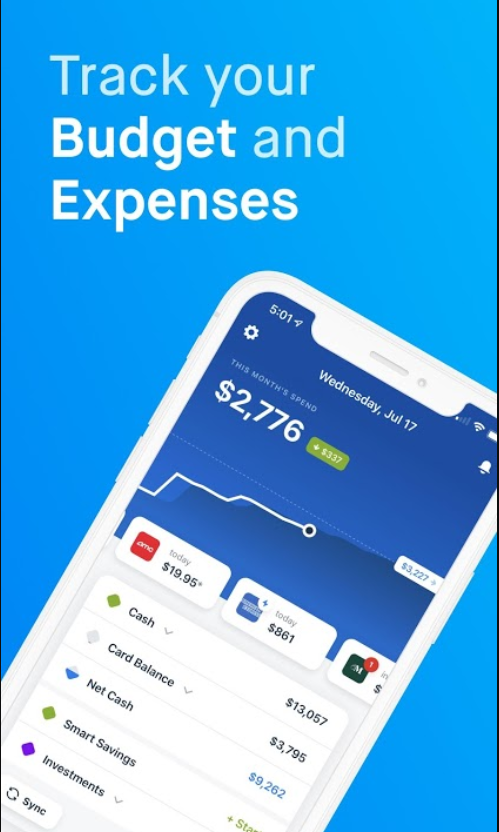

Owners of a business must keep records of expenses, wages, income, insurance, taxes, and tax benefits. The best way to handle these details is to hire professionals to do bookkeeping as we know that keeping your books in order will make everything easier to manage. Here are some why you should hire outsource bookkeeping for your small business.

Perform Tasks Faster

Experienced do this work every day. Private companies can evaluate their organization and find out which business approach is most appropriate for their finances. In addition, a company can perform these tasks faster than the standard owner.

Offer Affordable Prices

Outsourcing is a distinctive service that tends to perform various tasks related to enterprises with less money. Outsourcing the accounting of small businesses should make it easier for business owners to alleviate this pressure, which ideally comes from overwork. In addition, maintaining staff trained to do the accounting work will be a fantastic expense. You will feel how the small business will work only if you pay a lot for your staff.

Save Your Time

Accounting includes managing financial records, the company’s income, profits and losses, and many different expenses. At the time of the tax session, a small oversight can cause difficulties even if you are busy with a surplus of the accounting function. Each account may fail, or the costs and accounts may not match this dilemma. During this period, outsourcing is determined by your own salvation. By outsourcing these services, you save not only your time …

Accounting includes managing financial records, the company’s income, profits and losses, and many different expenses. At the time of the tax session, a small oversight can cause difficulties even if you are busy with a surplus of the accounting function. Each account may fail, or the costs and accounts may not match this dilemma. During this period, outsourcing is determined by your own salvation. By outsourcing these services, you save not only your time …